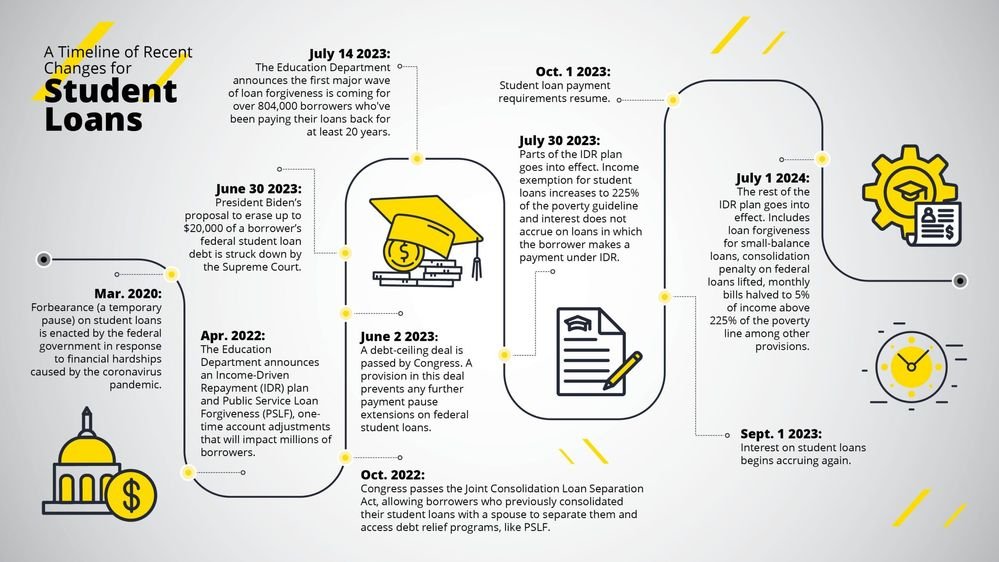

A Timeline of Recent Changes for Student Loans

Mar. 2020: Forbearance (a temporary pause) on student loans is enacted by the federal government in response to financial hardships caused by the coronavirus pandemic.

Apr. 2022: The Education Department announces an Income-Driven Repayment (IDR) plan and Public Service Loan Forgiveness (PSLF), one-time account adjustments that will impact millions of borrowers.

Oct. 2022: Congress passes the Joint Consolidation Loan Separation Act, allowing borrowers who previously consolidated their student loans with a spouse to separate them and access debt relief programs, like PSLF.

June 2 2023: A debt-ceiling deal is passed by Congress. A provision in this deal prevents any further payment pause extensions on federal student loans.

June 30 2023: President Biden’s proposal to erase up to $20,000 of a borrower’s federal student loan debt is struck down by the Supreme Court.

July 14 2023: The Education Department announces the first major wave of loan forgiveness is coming for over 804,000 borrowers who’ve been paying their loans back for at least 20 years.

July 30 2023: Parts of the IDR plan goes into effect. Income exemption for student loans increases to 225% of the poverty guideline and interest does not accrue on loans in which the borrower makes a payment under IDR.

Sept. 1 2023: Interest on student loans begins accruing again.

Oct. 1 2023: Student loan payment requirements resume.

July 1 2024: The rest of the IDR plan goes into effect. Includes loan forgiveness for small-balance loans, consolidation penalty on federal loans lifted, monthly bills halved to 5% of income above 225% of the poverty line among other provisions.